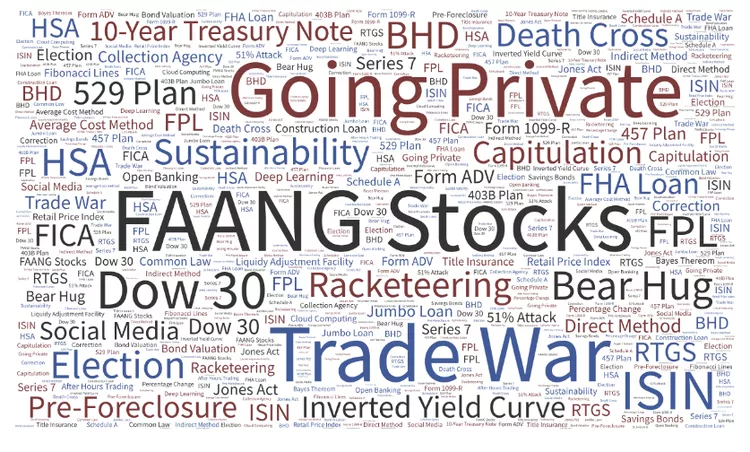

We combed through hundreds of millions of page views from our readers in order to determine which economic concepts they were most interested in finding. 2018 gave us the following:

- The market has been extremely volatile, the likes of which we have not witnessed in a number of years;

- The meteoric rise in price of the FAANG stocks, which have reached astronomical levels;

- A trade war between the United States and China, which rattled markets all over the world;

- An inverted yield curve in the United States Treasury market, which signalled a potential downturn in economic activity;

- A futurist CEO who tweeted that they were considering going private at a price of $420 per share, which turned out to be more expensive than anticipated;

- The detention of a rapper on charges related to racketeering (of all things); and

- Unsettling chart patterns for equities that indicate the market will continue to be volatile for an extended period of time.

- We combed through hundreds of millions of page views from our readers in order to determine which economic concepts they were most interested in finding. 2018 gave us the following:

- The market has been extremely volatile, the likes of which we have not witnessed in a number of years;

- The meteoric rise in price of the FAANG stocks, which have reached astronomical levels;

- A trade war between the United States and China, which rattled markets all over the world;

- An inverted yield curve in the United States Treasury market, which signalled a potential downturn in economic activity;

- A futurist CEO who tweeted that they were considering going private at a price of $420 per share, which turned out to be more expensive than anticipated;

- The detention of a rapper on charges related to racketeering (of all things); and

- Unsettling chart patterns for equities that indicate the market will continue to be volatile for an extended period of time.

Trade War

This comes as no surprise. When President Trump proposed additional taxes on steel imports in March, this term saw a 600% rise in search volume. China referred to this as a "serious attack" on trade and stated that they will respond in kind. They did, and as a result, the rising tariff conflict has shaken investors' confidence in markets all across the world, from Shanghai to St. Louis. Additionally, it has shown how interconnected and globalized the industrial world has become as a result of globalization. The United States-Mexico-Canada Agreement (USMCA), which will eventually take the place of the North American Free Trade Agreement (NAFTA), was also ratified in 2018. In point of fact, 2018 was a great year for our readers to brush up on their knowledge of international economics.

FAANG Stocks

On the basketball floor, they would call this a "layup." The headlines were dominated by Facebook, Apple, Amazon, Netflix, and Google, and these companies lifted market indexes to record highs before pulling them back down. In 2018, there was a 400% increase in the number of visits to our FAANG term, and for six months of the year, it was among the top 10 most-read terms. Each organization had its own unique and significant history, and they all continue to have an impact on how we learn, shop, engage with one another, and entertain ourselves. Whether it was Apple and Amazon becoming the first companies to reach a trillion dollars in market value, Facebook playing dangerous games with our personal and political data, Apple stunning us with new gadgets that don't sell as much as they used to, Netflix competing with us for sleep, and Google being, well... We are completely dependent on Google and the other FAANG companies.

Making a Private Move

I am grateful to you, Elon. The now-famous tweet sent out by the CEO of Tesla, which said "...Am considering taking Tesla private at $420. The tweet "Funding obtained" sent on August 7 caused Twitter to light up like a solar farm. #toosoon. Traffic to the phrase increased by 250% during that month and continued to be high even after Musk continued to light the flames of regulatory controversy and trash the SEC. In addition to that, Musk lost his chair, paid the SEC fines totaling $20 million, and had his market value drop by tens of millions of dollars. We'll never know whether Musk truly believed his tweet would be a strong evidence of corporate governance or whether he was in a haze as a result of working too hard and daydreaming about Mars when he sent it. It was successful in educating many of our readers about the meaning of Going Private. I appreciate it, Elon.

Racketeering

Younger members of our staff here at Investopedia were familiar with the name Tekashi69, sometimes known as 6ix9ine, before readers' curiosity about his suspected involvement in illegal activity led them to our definition of racketeering. The rapper, whose birth name is Daniel Hernandez, was taken into custody in November on allegations of racketeering and guns possession, and he faces the possibility of spending the rest of his life behind bars. Because racketeering can involve anything from gambling to cyber extortion to kidnapping, Tekashi69's bad behavior helped educate hundreds of thousands of readers on our site about the nature of racketeering. The charges that have been brought against him have little or nothing to do with financial crimes. Simply in the month of November, our definition of racketeering attracted more than 300,000 visitors.

Sustainability

It is unclear whether readers were interested in learning about sustainable investment because they were curious about the viability of record market highs or because they wanted to learn about sustainable investing. We are well aware that a significant number of our readers, particularly the younger ones, have a significant amount of interest in the latter. That is a positive development, particularly in view of the potentially catastrophic implications of climate change and the pressing need to take action to prevent its progression. We have high hopes that people will continue to show interest in this subject, and you can count on us to keep fueling that desire.

Dow 30

Visits to this phrase are guaranteed to be fruitful whenever new record highs are set for the Dow Jones Industrial Average or other markets. We tend to forget that a significant number of individuals are unaware that the Average consists of merely 30 stocks. It's debatable if those thirty are the most accurate depictions of the industry in 2018, but we'll save that discussion for another occasion. This year, General Electric was removed from the Dow, while Walgreens was added. GE had been a mainstay on the index for decades. The world we live in is undergoing a sea change.

Capitulation

When you reach the point where you just can't take it anymore... This concept always comes to the forefront during times of intense market volatility. 2018 has been full of both, but there hasn't been any complete capitulation as of yet. We've seen a lot of both, though. Anyone who was alive in 1987, 2000, or 2009 can attest to the fact that it does not present a beautiful picture. We have a feeling that people will still be using this term a lot in the coming year.

The Cross of Death

It sounds like something out of Game of Thrones, and there's a chance that it actually is. Stocks such as Facebook and Amazon, in addition to important indexes such as the S&P 500 and the Russell 2000, fell victim to the horrific technical analysis pattern more than a few times this year. Its ghastliness reared its ugly head more than once. The death cross is a technical pattern that can be seen on a chart when the short-term moving average of a stock drops below its long-term moving average. The moving averages of the last 50 and 200 days are the ones that are utilized in this pattern the majority of the time. This indicates that a stock or index has broken through its recent lows and may continue to move lower in the near future... otherwise known as "winter is coming!"

Yield Curve That Is Inverted

This is not a yoga position, yet in 2018 it caused us to lose our breath on more than one occasion. When the yield on long-term interest rates is lower than the yield on short-term interest rates, as we saw this fall with the 5-year U.S. Treasury and the 3-year U.S. Treasury, it is a sign that the economy may be headed for a slowdown and possibly a recession. This was the case with the 5-year U.S. Treasury and the 3-year U.S. Treasury. The inversion between the yield on the 10-year United States Treasury note and the yield on the 2-year United States Treasury note is typically what causes the market to twitch, but we haven't seen that yet this year. We are almost there, which is why you should expect to hear more about this topic in 2019. Breathe.

Ten-year Treasury Notes

See the prior sentence. As a result of the Federal Reserve raising interest rates and the economy in the United States showing indications of slowing down, the yield on the benchmark United States Treasury note has increased while the price of the note has decreased. Any increase in yield will be immediately noticeable in our personal finances because so many other interest rates, such as those for mortgages and auto loans, are based on the 10-year. On the other side, because interest rates have remained so low for such a long period of time, people who live on a fixed income and savers are now seeing a return on their investments. Expect to hear more about the 10-year Treasury in 2019, given that it is usually an essential and popular investment option.

Honorable Mentions

In addition, there were a few honorable mentions for this year's competition. These were financial terms that witnessed a significant growth in the number of readers, in comparison to their index for the previous four years. To get a better understanding of why individuals were so interested in some of them required additional research.

Bear Hug

It is not a warm and fuzzy hug when a firm or group of investors makes an unsolicited bid to buy the shares of another company at a higher price than where it trades. This might happen when one company makes a bid to buy the shares of another company. But as we thought back on the year, we couldn't come up with too many examples of this in the public markets that were particularly notable. It appears that we have HBO, and more specifically the drama Succession, to thank for this accomplishment. It follows the story of a family-owned media firm that is run by a King Lear-like magnate, Logan Roy, who is portrayed by Brian Cox, and his son, Kendall Roy, who is portrayed by Jeremy Strong, who is attempting to wrestle control of the company away from his unpredictable father. Indeed, search interest in the keyword "Bear Hug" began to skyrocket in the late summer, at the same time that episodes 9 and 10 of the first season of "Bear Hug" were reaching their climactic point, with Kendall making a violent push for Westar during the wedding of his sister. We won't give anything away about the ending, but we are ecstatic that the programmed will be returning for a second season!

Pre-foreclosure

Given that the number of homes lost to foreclosure in the United States is at a multi-year low and that the housing market is in a significantly healthier situation than it was ten years ago, we were taken aback by this development. Despite this, interest rates on mortgage loans are climbing, and the property markets in several of the nation's largest cities remain rather unstable. When a borrower has fallen behind on their mortgage payments and the borrower's bank or lender has begun the process of foreclosure, the borrower is said to be in pre-foreclosure. When homes enter this state of purgatory, there are certain opportunistic real estate speculators who begin to circle the area.

GDPR

We are certain that there are a great number of chief technology officers, chief security officers, and developers who have battle scars as a result of the implementation of the requirements of the General Data Protection Regulation (GDPR) in 2018, but let's hope that we are all a little safer for them. The General Data Protection Regulation (GDPR) is the regulatory scheme that governs the gathering and handling of personal data of individuals inside the European Union (EU). The General Data Protection Regulation (GDPR) lays out the rules for data management and the rights of the individual, as well as imposing substantial fines on those who do not comply with the regulations. You need to have a solid understanding of these four letters if you plan on doing digital trade in Europe.