A monetary system known as the "gold standard" links the value of a nation's currency or paper money directly to the price of gold. Countries agreed to exchange paper money for a specific amount of gold under the gold standard. A nation that adheres to the gold standard establishes a fixed gold price and buys and sells gold at that rate. The value of the currency is established using that fixed price. The worth of a dollar, for instance, would be equal to 1/500th of an ounce of gold if the U.S. set the price of gold at $500 per ounce.

No government presently employs the gold standard. The U.S. and Britain both stopped utilising the gold standard in 1933, and the remaining elements of the system were officially abolished in 1973.

Fiat money, which is utilised because of a government's decree, or fiat, that the currency must be accepted as a form of payment, totally supplanted the gold standard. For instance, the dollar is fiat money in the United States, but the naira is fiat money in Nigeria.

An advantage of a gold standard is that it removes human beings' imperfect ability to govern the creation of money. A community can adhere to a straightforward guideline to prevent the ills of inflation by using the physical amount of gold as a limit on that issuance. In addition to preventing inflation and deflation, monetary policy aims to support a stable financial environment that will allow for the achievement of full employment.

A cursory look at the history of the U.S. gold standard is sufficient to demonstrate that inflation may be avoided when such a straightforward rule is implemented, but that rigid adherence to that rule can lead to economic instability, if not political unrest.

KEY LESSONS

- A monetary system known as the "gold standard" ties the value of a currency to the price of gold.

Gold was a symbol of worship before it was a means of exchange.

- England established the gold standard as the first nation after making significant gold discoveries.

The Bretton Woods agreement established the U.S. dollar as the primary reserve currency and its fixed rate of $35 per ounce of gold conversion.

- President Nixon ended the dollar's ability to be converted into gold in 1971.

Fiat vs the Gold Standard System

The word "gold standard" describes a monetary system where a currency's value is dependent on gold, as suggested by its name. Contrarily, a fiat system is a monetary system in which a currency's value is not based on any actual commodities but is instead permitted to dynamically fluctuate against other currencies on the foreign exchange markets.

The Latin word fieri, which means an arbitrary act or decree, is where the word "fiat" originates. According to this derivation, the value of fiat currencies ultimately rests on the fact that they have been declared legal tender by government order.

International trade in the years leading up to World War One was based on what is now referred to as the "classical gold standard." In this arrangement, actual gold was used to settle international transactions. Gold was accumulated by countries with positive trade balances as payment for their exports. In contrast, countries with trade deficits saw a drop in their gold holdings as gold left those countries to be used as payment for imports.

A History of the Gold Standard

President Herbert Hoover famously told Franklin D. Roosevelt, "We have gold because we cannot trust governments," in 1933. This declaration predicted the Emergency Banking Act, which compelled all Americans to exchange their gold coins, bullion, and certificates for U.S. dollars and was one of the most severe financial crises in American history.

Even though the legislation was successful in halting the flow of gold during the Great Depression, gold bugs' unwavering belief in the stability of gold as a store of wealth was unaffected.

In that it has a special impact on its supply and demand, gold has a history unlike that of any other asset class. Gold has a history that involves a collapse that must be understood in order to accurately predict its future, but gold enthusiasts still cling to a time when it ruled.

A 5,000-year love affair with the gold standard

Since it combines lustre, malleability, density, and scarcity like no other metal does, gold has captivated humans for 5,000 years. One tonne of gold may fit inside a cubic foot, according to Peter Bernstein's book The Power of Gold: The History of Obsession.

The Early Years, Gold

A visit to any of the world's historic sacred sites will show that gold was once only used for worship. Today, making jewellery is the most common application of gold.

Gold was initially fashioned into coins around 700 B.C., which increased its usefulness as a unit of exchange. Prior to this, while settling trades, gold had to be weighed and its purity verified.

40 Countries refuse to use the USD.

— Ariel (@Prolotario1) May 17, 2023

81 Countries are headed to a conference in June for gold standard return.

25+ States are introducing gold/silver.

142 countries will simultaneously dump the USD.

Whoever is holding these countries currencies will become wealthy overnight. pic.twitter.com/tkZjJVgm4P

Since clipping these slightly uneven gold coins to gather enough gold to melt down into bullion was a frequent practice for generations to come, gold coins were not a perfect answer. The Great Recoinage in England created a technique that automated coin manufacture and eliminated clipping in 1696.

The only ways that the quantity of gold might have increased were through deflation, trade, looting, or debasement since it could not always rely on further supplies from the ground.

An alternative to the Gold Standard

America experienced its first significant gold rush in the fifteenth century. The New World treasures that Spain stole increased Europe's gold supply by five times in the 16th century. In the 19th century, there were other gold rushes in the Americas, Australia, and South Africa.

Using debt instruments issued by private parties, paper money was first used in Europe in the 16th century. The dominance of gold coins and bullion in the European monetary system persisted until the 18th century, when paper money started to take over. A gold standard would finally be implemented as a result of the conflict between paper money and gold.

How the Gold Standard Has Increased

A monetary system known as the "gold standard" allows for the freely convertible exchange of paper money for a set quantity of gold. In other words, in a system like this, the value of money is backed by the worth of gold. The advent of paper money caused certain issues, which led to the establishment and formalisation of the gold standard between 1696 and 1812.

In 1789, the U.S. Constitution granted Congress the exclusive authority to mint money and the authority to set its value.

A monetary system that had previously been based on circulating foreign coin, primarily silver, was able to be standardized thanks to the creation of a single national currency.

A New Standard for Silver and Gold

Considering that silver was more plentiful than gold, a bimetallic standard was chosen in 1792. Gresham's law states that after 1793, the value of silver rapidly decreased, driving gold out of circulation while the officially adopted silver-to-gold parity ratio of 15:1 accurately mirrored the market ratio at the time.

The problem wouldn't be fixed until the Coinage Act of 1834, and even then there was a lot of political hostility. In order to push out the then-despised Bank of the United States' small-denomination paper notes, hard-money supporters argued for a ratio that would put gold coins back into circulation. This was done less so to push out silver as to do so to push out small-denomination paper notes. The U.S. was put on a de facto gold standard when a ratio of 16:1 that clearly overpriced gold was established and reversed the situation.

Adoption of the Gold Standard

England was the first nation to formally adopt the gold standard in 1821. Large gold discoveries made possible by the century's tremendous growth in global trade and industry allowed the gold standard survive well into the following century. Governments had a strong incentive to accumulate gold reserves because all trade imbalances between nations were settled in gold. These stocks are still in place right now.

Following Germany's adoption of the gold standard, the global gold standard was established in 1871. The majority of developed nations had adopted the gold standard by 1900. Ironically, the United States was among the last nations to sign on. In actuality, during the 19th century, a powerful silver lobby kept gold from being the exclusive currency in the United States.

Related link : The Cryptographic Indicator for the Market in Precious Metals

The peak of the gold standard occurred between 1871 and 1914. Near-ideal political circumstances prevailed in the majority of the nations that introduced the gold standard during this time, including Australia, Canada, New Zealand, and India. However, everything changed in 1914 when the Great War started.

How the Gold Standard Failed

Political allegiances shifted, there was an increase in global debt, and government finances declined as a result of World War I. The gold standard was in limbo during the war, even though it wasn't suspended, showing that it couldn't endure both good and terrible times. This led to a loss of faith in the gold standard, which only made the economy's problems worse. It became more and more clear that the world needed a more adaptable foundation for its global economy.

Nations continued to harbor a strong desire to go back to the idealistic days of the gold standard at the same time. The British pound sterling and the US dollar took over as the world's reserve currencies as the gold supply continued to lag behind the expansion of the global economy. Smaller nations started to keep more of these currencies as opposed to gold. The end result was an enhanced concentration of gold in the hands of a small number of powerful nations.

One of the many post-war challenges faced by the world was the stock market crash of 1929. The pound and the French franc were out of sync with other currencies, Germany was still being choked by war debts and repatriations, commodities prices were falling, and banks were overextended. Many nations made an effort to safeguard their gold reserves by increasing interest rates in an effort to persuade investors to hold onto their deposits as opposed to exchanging them for gold.

The global economy was only harmed by these rising interest rates. Only the United States and France had significant gold holdings after the suspension of the gold standard in England in 1931.

Then, in order to boost its economy, the United States government increased the value of gold from $20.67 per ounce to $35 per ounce in 1934.

he dollar immediately saw a sharp depreciation as other countries were able to exchange their existing gold stockpiles for additional US currency. Due to the greater conversion of gold into dollars at the higher price, the United States was able to effectively control the global gold market. By 1939, there was enough gold in the world to replace all fiat money in circulation due to an increase in gold production.

The US and gold are at odds. Dollar

Leading Western nations gathered as World War II was nearing to a conclusion to create the Bretton Woods Agreement, which would govern the world's currency markets until 1971. All national currencies were valued according to the U.S. dollar, which emerged as the primary reserve currency, under the Bretton Woods arrangement. The dollar may then be exchanged for gold at a set price of $35 per ounce. Even though it did so more covertly, the gold standard remained the foundation of the world financial system.

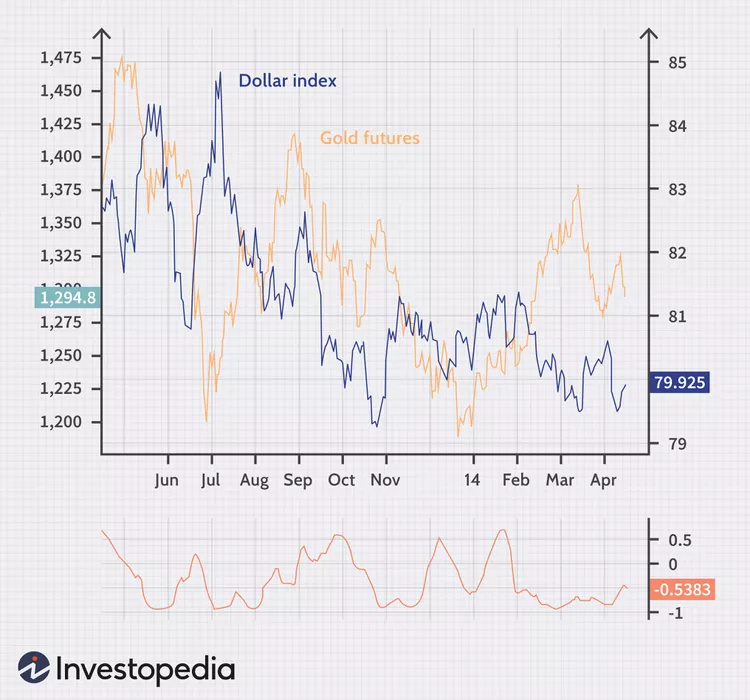

Over time, the agreement has produced an intriguing relationship between gold and the dollar. Over time, higher gold prices are typically associated with a sinking dollar. The accompanying one-year daily chart shows that this isn't always the case and that the relationship can be, at best, shaky. Observe how the correlation indicator in the following figure alternates between a significant negative correlation and a positive correlation. Although the correlation is still biassed in favour of the inverse (negative on the correlation analysis), gold normally falls when the dollar increases.

The dollar was the only currency still being directly backed by gold at the end of World War II, and the United States possessed 75% of the world's monetary gold. However, when the world recovered from World War II, money began to flow to war-torn countries and the United States' own large import needs, which caused its gold reserves to steadily decline. The gold standard lost its last bit of breath in the late 1960s' strong inflationary environment.

Golden Pool

The United States and several other European countries formed the Gold Pool in 1968 and stopped selling gold on the London market, allowing the market to freely set the price of gold. Only central banks were permitted to trade with the United States at $35 per ounce from 1968 to 1971. The market price of gold might be kept in line with the official parity rate by having a pool of gold reserves accessible. This reduced the pressure on member countries to sustain their export-led growth objectives by appreciating their currencies.

However, the Vietnam War and the monetization of debt to fund social programmes as well as the rising competitiveness of other countries quickly started to strain America's balance of payments. Sen. John F. Kennedy said in the final weeks of his presidential campaign that he would not try to weaken the dollar if elected, despite a surplus turning into a deficit in 1959 and growing concerns that other countries might start exchanging their dollar-denominated assets for gold.

Due to member countries' reluctance to fully cooperate in keeping the market price at the gold price in the United States, the Gold Pool dissolved in 1968. The Netherlands and Belgium both exchanged currencies for gold in the years that followed, and Germany and France declared similar intentions.

Nixon was forced to act when Britain demanded payment in gold in August 1971, thereby closing the gold window. By 1976, it was established that the dollar would no longer be pegged to gold, effectively ending the gold standard as we knew it.

Nixon ended the direct exchange of US money for gold in August 1971. With this choice, gold was no longer formally linked to the world currency market, which had been becoming more and more dependent on the dollar ever since the Bretton Woods Agreement came into effect. The U.S. dollar entered the age of fiat money, and consequently, the global financial system it effectively supported.

Questions and Answers

What Benefits Does the Gold Standard Offer?

Because governments and banks are unable to control the money supply (for example, by printing too much money), the gold standard prevents inflation. The gold standard also maintains pricing and exchange rate stability.

What Are the Gold Standard's Drawbacks?

The supply of gold cannot keep up with demand under the gold standard, and it is not adaptable during difficult economic times. Additionally, gold mining is expensive and has detrimental environmental externalities.

How Come the U.S. Leave the Gold Standard in place?

In order to control inflation and stop foreign countries from overloading the system by exchanging their dollars for gold, the United States gave up the gold standard in 1971.

Which nations currently use the gold standard?

Today, no nation still follows the gold standard, despite several having sizable gold reserves.

What Is the Gold Standard's Alternative?

Silver dominated commercial exchanges before gold did. Fiat money replaced the gold standard as the preferred alternative following its collapse.

The conclusion

Even though gold has intrigued people for at least 5,000 years, it hasn't always served as the foundation of the financial system. Between 1871 and 1914, a genuine international gold standard was in place for less than 50 years.

Even though a weaker version of the gold standard persisted until 1971, its demise had already begun decades earlier with the invention of paper money, a more adaptable currency for our intricate financial system. Although it is no longer used as a standard, gold still has a significant role to play today and its price is decided by the demand for the metal. For nations and central banks, gold is a significant financial asset. Additionally, banks utilise it as a tool to protect themselves against government loans and as a gauge of the strength of the economy.

In a free-market economy, gold should be seen as a form of money similar to the euro, yen, or the dollar. Gold and the U.S. dollar have a long-standing relationship, and they often move in the opposite direction over time. It is usual to hear discussions of establishing a new gold standard due to market volatility, however such a system is not without flaws.

When compared to paper money and the economy, trading gold as a currency can reduce risks, but it is important to understand that gold is a forward-looking asset. Waiting until a calamity happens could not be advantageous if the pricing has already changed to reflect the weakening economy.