The CRSP, Dow, Russell, and S&P are the four primary indexes that measure the performance of mid-cap stocks.

Investors who are interested in measuring the relative performance of mid-cap stocks or investment vehicles that contain mid-cap equities, such as exchange-traded funds (ETFs) and mutual funds, might use a mid-cap index as a standard against which to compare the performance of their holdings. A market capitalization or market value that normally falls between $2 billion and $10 billion is considered to be that of a mid-cap stock. This definition applies to any equity asset.

The range of approximately $3 billion to $10 billion is what some investing businesses consider to be the mid-cap market.

However, that range is not fixed, and the limits at its extremes are subject to change. Mid-cap firms, in spite of these variations, are often in the middle of their growth curves, and it is anticipated that they will produce consistent increases in their profitability, market share, and productivity over the coming years. Even though they are not nearly as precarious as small-cap stocks, mid-cap stocks are typically more volatile than large-cap stocks.

The success of investments in mid-cap companies can be evaluated relative to a variety of mid-cap indices, which serve as benchmarks. None of them come close to matching the level of dominance and popularity possessed by the S&P 500 Index, which serves as the default benchmark for a huge number of large-cap stocks and funds. Indeed, the S&P 500 is followed by all three of the leading large-cap exchange-traded funds (ETFs) in terms of assets under management (AUM).

On the other hand, each of the top three mid-cap ETFs follows a different index than the others. In addition, there are four distinct broad-based indexes that are tracked inside the top 10 markets (there are other indexes but they are themed indexes, such as value or growth, rather than broad-based).

The ETF Database provided the information used here, and it is current as of April 7th, 2022.

The following are the four mid-cap indexes:

- CRSP's Index of U.S. Midcap Companies (CRSPMI1)

- Russell Midcap Index (RMCC)

- Mid-Cap Total Stock Market Index calculated by Dow Jones for the United States (DWM)

- S&P MidCap 400 Index (SP400)

When compared to the world of large-cap companies, the universe of mid-cap companies does not have a clear index leader, and the four indexes that have been described above vary quite a little from one another. Because of this, investing in mid-cap companies is somewhat more difficult than investing in large-cap companies. For the purpose of determining whether or not a given investment is outperforming or underperforming its benchmark, it is essential to have a good understanding of which index should be used as the benchmark. In the following section, we will take a closer look at the four mid-cap indexes that were mentioned earlier in order to provide investors with a better idea of which mid-cap index should be utilized for whatever kind of mid-cap investments.

KEY TAKEAWAYS

- A stock is considered to be a mid-cap stock if its market capitalization is typically between $2 billion and $10 billion.

- There are four different mid-cap indexes: the CRSP U.S. Mid Cap Index, the Russell Midcap Index, the Dow Jones U.S. Mid-Cap Total Stock Market Index, and the S&P MidCap 400 Index. Each of these indexes measures the performance of a certain market segment.

- The characteristics of these indexes are very different from one another, and none of them have achieved the same level of domination among investors as the S&P 500 has with regard to large-cap indexes.

- This indicates that investors need to be aware of the most appropriate index to use as a benchmark in order to assess the success of their holdings in companies that are classified as mid-cap.

- All of this demonstrates that the dividing lines between categories like as "large-cap" and "mid-cap" are, in the end, completely arbitrary, despite the fact that keeping track of market capitalization is a vital consideration to keep in mind while studying companies.

The information in the rows labeled "Number of Stocks" to "Weight of the Top 10" is current as of March 31, 2022, and comes from the following sources: the CRSP U.S. Mid Cap Index; the Russell Midcap Index and iShares Russell Mid-Cap ETF, which tracks the Russell Midcap Index; the Dow Jones U.S. Mid-Cap Total Stock Market Index (download factsheet PDF); and the S&P MidCap 400 Index (download factsheet PDF); all

Breakdown of the Index Sectors

Each of the four primary mid-cap indexes employs a somewhat unique breakdown of the primary market sectors in its calculations. For instance, rather than the more common "Consumer Discretionary" and "Consumer Staples" sectors, DWM employs a "Consumer Services" sector and a "Consumer Goods" sector. In addition to this, it refers to the "Energy" sector as the "Oil & Gas" sector, and it does not have a distinct "REITs/Real Estate" sector. Both DWM and CRSPMI1 use the outdated "Telecommunications" sector categorization, which was changed to "Communication Services" in 2018. This change took occurred in 2018.

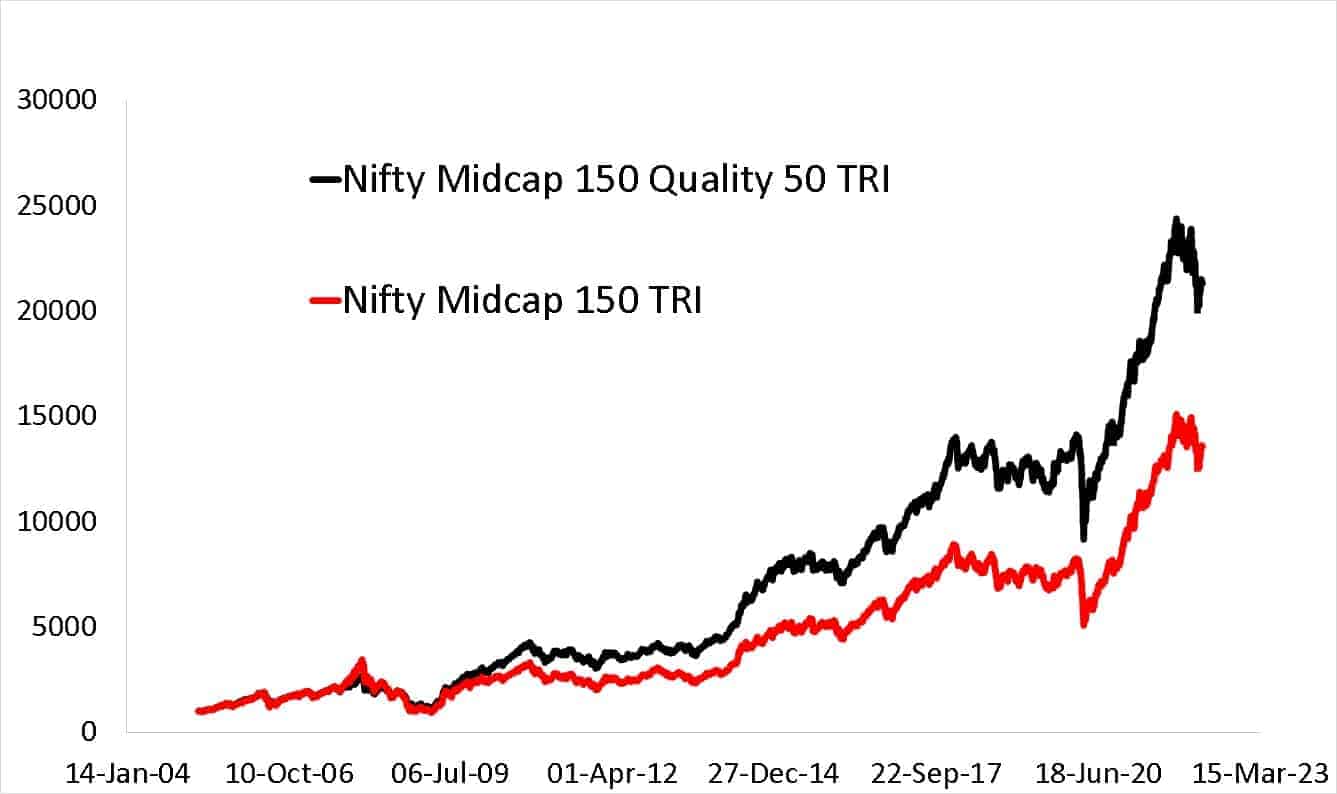

Many people believed that small-cap & mid-cap indexes deliver higher returns than Sensex.

— Vivek (@Vivek_Investor) October 9, 2022

Here is what the data shows 👇

Src: o3 securities letter. pic.twitter.com/gTQKom25gm

There are a few other subtle distinctions in classification, such as the use of the term "Materials" rather than the more conventional "Basic Materials." However, these distinctions are rather insignificant. We have mentioned, in the relevant cell of the table below, the places where there are differences in the naming of sectors that are used by the various indexes. These differences may be found in the table below. Also, keep in mind that data for the sector breakdown was not able to be obtained for RMCC; instead, the sector classification utilized by the iShares Russell Mid-Cap ETF (IWR), which follows RMCC, was used as a proxy in its place.

An Examination of Mid-Cap Indexes: Determining What Constitutes a Mid-Cap

It is clear from the investigation of the four different mid-cap indexes shown above that "mid-cap" is a classification of market capitalization that has fluid borders. None of the indices follows the conventional range for market capitalization, which is between $2 billion and $10 billion. They also do not have the same amount of constituents, with RMCC having the biggest number of total stocks out of the three of them at 824.

The sector breakdowns of each index are also quite different from one another in a substantial way. This should also assist highlight that the dividing lines between the size categories firms are placed in are, ultimately, arbitrary. Market capitalization is a significant criterion when examining equities, but the dividing lines between the size categories companies are placed in are arbitrary.

The S&P 400 Index is the one that replicates the typical market capitalization range the most accurately. The index's range is the smallest when compared to the other three indices, despite the fact that both its greatest and smallest market cap is still outside the spectrum. The S&P 400 can go as low as $1.6 billion and as high as $17.3 billion in terms of its range. The median and mean market capitalization of the S&P 400 are both located in a region that is quite close to the traditional classification range's center. When compared to CRSPMI1 and RMCC, the S&P 400 allocates 18.7% of its total weight to the industrial sector. This is a significantly higher weighting than that of the RMCC. Nevertheless, that weighting is less than the weighting that DWM uses for industrials in their calculations.

The DWM index is the only other one for which both the mean and the median are located inside the traditionally acceptable range. At $9.1 billion and $8.0 billion, respectively, its mean and median market cap is also just a hair below the top boundary. However, the DWM stock with the biggest market cap is much over that upper border, with a market value of $40.0 billion; it is the stock with the largest market cap within DWM. The stock with the smallest market capitalization may be found in the DWM index, which has a total value of $40.9 million. When looking at the breakdown of sectors, it is important to note that DWM has unusually high weightings in the financial and industrial sectors, with percentages of 24.0% and 20.9%, respectively.

The market capitalization of RMCC's stock is the highest of any stock, coming in at $61.4 billion. This most likely helps to explain why RMCC has a mean market valuation of $24.0 billion, which is more than double the upper threshold of the range of possible market caps for a mid-size stock.

The weight of its greatest ingredient, as well as the aggregate weight of the top 10 constituents, is the lowest out of all of the indexes; however, if we use IWR as a proxy for RMCC (since data was not available for RMCC), the weight of its largest constituent is the lowest. When compared to the other indices, RMCC's sector weightings for the information technology and healthcare industries are the highest. RMCC does this by once again employing IWR as its proxy. Within the context of the index, the sector that is given the most weighting is information technology.

CRSPMI1 is the index that best exemplifies this tilt toward large-cap stocks. The weight of its top 10 constituents is 6.7%, making it the index with the highest weighting overall out of the four that were considered. As was said earlier, the market capitalization of the RMCC is $61.4 billion, which is significantly higher than the market cap of the CRSPMI1 stock with the greatest market capitalization, which is $51.0 billion. However, both the mean and median market caps of CRSPMI1, which are $18.2 billion and $19.0 billion, respectively, are significantly higher than the conventional range for a mid-cap stock. When compared to the other three indexes, the CRSPMI1 index assigns the highest weighting to the utility sector. 11 However, the information technology sector is given a weighting that is far greater than any other sector in the index.

The Bottom Line When it comes to selecting a standard against which to evaluate the performance of their mid-cap holdings, investors have four primary indexes from which to choose. Because each of the indices is monitored by some of the most significant mid-cap ETFs, there is no index that is significantly more influential than the others. They are not interchangeable due to the fact that they each possess distinctive qualities. Each of the indices contains stocks that are not often thought of as being in the mid-cap range. In fact, the mean and median market capitalization of a couple of the indexes are much higher than the top boundary of the range that is normally considered to be in the mid-cap range.

When looking at stocks, it is crucial for investors to take into consideration the market capitalization of the companies they are considering buying. However, the boundaries between categories such as "mid-cap" and "large-cap" are ultimately arbitrary, and this fact should be kept in mind. This is especially obvious in the mid-cap arena, which features four indexes with significantly different average market caps despite belonging to the same category. The four indexes are also distinct from one another in terms of the number of assets they contain and the industries to which they are allocated. When selecting the index that best satisfies their own requirements for investing, investors should take all of these considerations into account, taking into account both their comfort level with risk and their unique monetary objectives.

SPONSORED

While Trading Digital Assets, You Could Win Up to $10,000.

Digital asset trading just become easier. When you trade assets and store them with OKX, a renowned provider of digital asset finance services, you have access to the highest possible level of protection. In addition to this, if you make a deposit of more than $50 through a cryptocurrency purchase or top-up within the first 30 days of registering an account, you will be entered into a drawing to win a Mystery Box with a value of up to $10,000. Find out more information and join up to claim your Mystery Box as soon as possible.