What Exactly Is Capital Expenditure Budgeting?

When developing a capital budget, a business must select projects that will increase the company's worth. The process of capital budgeting can encompass nearly anything, including the purchase of fixed assets such as a new truck or machinery, as well as the purchase of land.

Generally speaking, corporations are mandated, or at the very least strongly encouraged, to execute those initiatives that would boost profitability and, as a result, increase the wealth of shareholders.

However, the rate of return that is considered to be acceptable or unsatisfactory is determined by other elements that are specific to both the firm and the project.

As an illustration, the approval of a social or philanthropic project is frequently not predicated on the rate of return, but rather on the goal of a company to cultivate goodwill and contribute back to the society in which it operates.

KEY TAKEAWAYS

- The process through which investors assess the worth of a possible investment project is known as capital budgeting.

- The payback period (PB), the internal rate of return (IRR), and the net present value are the three methods of project selection that are utilized the most frequently (NPV).

- The payback period estimates the amount of time it will take for an organization to generate sufficient cash flows to recoup the value of the initial investment.

- The predicted return on a project is referred to as the internal rate of return; a project is considered profitable if its rate of return is greater than its cost of capital.

- The net present value is likely the most useful of the three approaches since it demonstrates how profitable a project will be in comparison to other options.

Understanding Capital Budgeting

- The creation of accountability and the ability to measure something is one of the primary purposes of capital budgeting. The owners or shareholders of a company would consider it irresponsible for the company to seek to spend its resources on a project without first having a clear grasp of the potential dangers and benefits associated with the endeavor.

In addition, if a company is unable to determine the degree to which the choices it makes about its investments are successful, there is a good probability that the company will not be able to thrive in today's cutthroat business environment.

Unless they are non-profit organizations, the primary purpose of businesses is to generate profits. The practice of capital budgeting provides companies with a measurable method for determining the long-term economic and financial profitability of any investment project. This method is utilized by enterprises.

When deciding whether to accept or reject capital budgeting projects, many types of firms utilize a variety of approaches to value. In many instances, the internal rate of return (IRR) approach and the payback period (PB) method are utilized in addition to the net present value (NPV) method, despite the fact that the NPV method is considered by analysts to be the most reliable and accurate of the three. When each of these three methods points to the same course of action, managers will have the utmost trust in the analysis they have performed.

How the Capital Budgeting Process Operates

When a company is faced with a decision regarding its capital budget, one of the first jobs that it must do is to establish whether or not the project will end up being profitable. The most frequent approaches to selecting projects are the payback period (PB), internal rate of return (IRR), and net present value (NPV) methodologies.

Although an ideal solution for capital budgeting would be one in which all three measures would point to the same choice, these approaches will typically give results that are in conflict with one another. There will be a preference for one method over another, and that choice will be determined by the preferences and selection criteria of management. Despite this, these frequently employed approaches to valuation each have their own set of benefits and drawbacks in common.

Payback Period

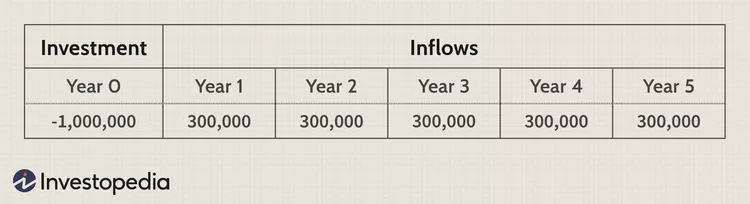

The payback period is the length of time that is calculated to be required in order to return the initial investment. For instance, if a capital budgeting project needs an initial cash outlay of one million dollars, the PB will disclose the number of years that will be necessary for the cash inflows to equal the one million dollar outlay. A shorter PB period is desired since it shows that the project would "pay for itself" within a shorter time frame. This is the case when the PB period is shorter.

In the following illustration, the PB term would be three years and four months, which is equivalent to three years and one-third of a year.

Payback periods are frequently implemented in situations in which liquidity poses a significant challenge. If a corporation only has a limited number of finances available to them, it is possible that it will only be able to work on one significant project at a time. As a result, management will place a significant emphasis on maximizing the return on their original investment so that they can move on to other ventures.

Once the cash flow estimates have been made, one further significant benefit of using the PB is that it is simple to compute. This is a significant advantage that should not be overlooked.

There are certain disadvantages associated with making judgments regarding capital budgeting based on the PB statistic. To begin, the payback period does not take into consideration the value of money over a longer period of time (TVM). Calculating the PB gives one metric that gives equal weight to payments received in years one and two. This metric can be found by following the calculation of the PB.

A mistake of this nature violates one of the core concepts underlying financial management. A model with a deferred payback period can, thankfully, be simply implemented to remedy this issue, which is fortunate. In its most basic form, the discounted PB period takes into account TVM and makes it possible to calculate the amount of time required for an investment to be recouped using discounted cash flow.

Payback periods and discounted payback periods both have the same downside, which is that they neglect the cash flows that occur near the end of a project's life, such as the salvage value. This is another disadvantage. As a result, the PB is not an accurate reflection of a company's profitability.

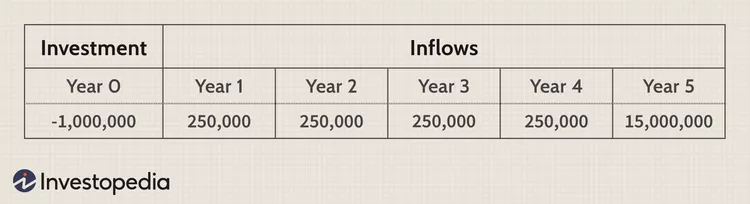

The following illustration has a PB period of four years, which is longer than the one that came before it; nevertheless, the significant cash influx of fifteen million dollars that takes place in year five is disregarded for the purposes of this statistic.

The payback technique has a number of other potential problems, one of which is the chance that monetary investments will be required at various stages of the project. It is also important to take into account the useful life of the asset that was purchased. It is possible that there will not be sufficient time to produce revenues from the project if the asset's life does not extend too far beyond the payback period.

The payback time is typically considered to be the least relevant valuation approach because it does not take into account the additional value that is created by a capital budgeting decision. However, if liquidity is a very important factor to take into account, PB periods are of the utmost significance.

Rate of Return on Investing Capital

The discount rate that would lead to a net present value of zero is the discount rate which is referred to as the internal rate of return (or projected return on a project). IRR calculations use the actual rate that the company uses to discount after-tax cash flows as their benchmark because the NPV of a project has a negative correlation with the discount rate. If the discount rate is increased, then future cash flows become more uncertain and, as a result, have less value.

If the internal rate of return (IRR) of a capital project is higher than the weighted average cost of capital, then it is likely that the project will generate a profit, and vice versa.

The rule for IRR can be summarised as follows:

- IRR Greater Than Cost of Capital Equals Acceptance of Project

- IRR Less Than Cost of Capital Equals Abandon Project

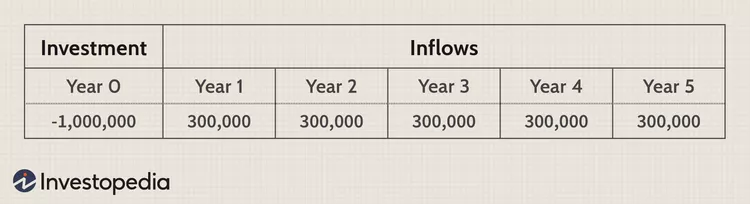

- The example that follows shows that the IRR is 15%. The project needs to be approved if the actual discount rate that the company employs for discounted cash flow models is lower than 15%.

The provision of a benchmark number for every project that can be evaluated in reference to a company's capital structure is the primary advantage of applying the internal rate of return as a tool for decision-making. Another advantage is that it may be implemented as a decision-making tool. The internal rate of return (IRR) will typically provide the same kinds of conclusions as net present value models, and it enables businesses to compare projects based on returns on invested capital.

Despite the fact that the IRR may be easily calculated using either a financial calculator or software programs, there are a few drawbacks associated with employing the use of this metric. The internal rate of return (IRR) technique, much like the PB method, does not give an accurate representation of the value that a project will add to a company; rather, it merely provides a benchmark figure for determining which projects should be accepted depending on the cost of capital for the company.

Because the internal rate of return does not permit an appropriate comparison of projects that are incompatible with one another, managers may be able to determine that projects A and B are both beneficial to the company, but they would not be able to determine which one is superior if only one project could be accepted.

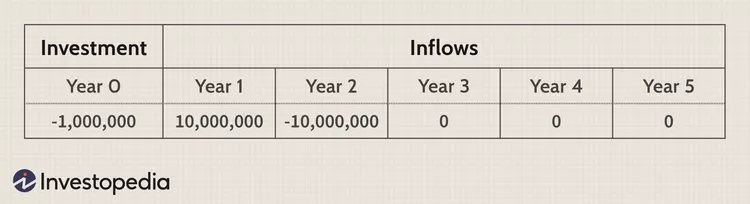

When the cash flow streams from a project are unconventional, which means that there are further cash outflows following the initial investment, there is another error that can occur when doing IRR analysis. This error occurs when there are additional cash outflows. The capital budgeting process frequently involves the use of non-traditional cash flows due to the fact that the majority of projects will require future capital outlays for the purpose of maintenance and repairs. In this kind of situation, an IRR might not be calculable at all, or there could be more than one internal rate of return. In the scenario that follows, there are two possible IRRs: 12.7% and 787.3%.

When examining individual capital budgeting projects, rather than projects that are mutually incompatible, the internal rate of return is a suitable valuation measure to apply. However, it does not fulfill a number of essential characteristics, despite the fact that it is a preferable option to the PB technique of valuation.

Net Present Value

The methodology known as net present value is the method of valuation that is both the most straightforward and accurate when applied to capital budgeting issues. Managers are able to estimate whether or not a project will generate a profit by discounting the cash flows that are generated after taxes by the cost of capital that is weighted on average. The net present value approach, in contrast to the internal rate of return method, shows exactly how profitable a project will be in relation to other possibilities.

According to the NPV rule, any projects that have a net present value that is positive should be accepted, while projects that have a net present value that is negative should be refused. In the event that there are insufficient finances and not all projects with a positive NPV can be started, those with the highest discounted value should be accepted.

In the two scenarios that are presented below, adopting a discount rate of 10% results in project A having an NPV of $137,236 whereas project B has an NPV of $1,317,856. These findings indicate that both of the capital budgeting projects would result in a rise in the value of the company; but, if the company currently only has one million dollars to invest, project B is the better option.

The overall applicability of the NPV methodology, as well as the fact that the NPV provides a clear measure of enhanced profitability, are two of the key advantages of using the NPV method. It is possible to assess various projects that are mutually incompatible at the same time using this method. Furthermore, despite the fact that the discount rate is prone to change, a sensitivity analysis of the NPV may often indicate any significant potential worries about the future.

Even though the NPV method is open to justifiable criticism on the grounds that the value-added figure does not take into account the overall magnitude of the project, the profitability index (PI), which is a metric that is derived from discounted cash flow calculations, can easily address this issue.

The profitability index can be arrived at by dividing the initial investment by the present value of the cash flows that are expected to be received in the future. If the NPV is positive and the PI is larger than 1, then the NPV is positive; however, if the PI is less than 1, then the NPV is negative. Although calculating the weighted average cost of capital (WACC) can be challenging, using it to evaluate the quality of an investment is a reliable strategy.

A Digital Wallet for All of Your Web3 Needs is Provided by Our Sponsor

Accessing a wide variety of Defi platforms, ranging from cryptocurrencies to NFTs and beyond, is much easier than you might imagine. When you trade assets and store them with OKX, a renowned provider of digital asset finance services, you have access to the highest possible level of protection. You can also link existing wallets and be entered into a drawing for a chance to win up to $10,000 if you make a deposit of more than $50 through the purchase of cryptocurrency or a top-up within the first 30 days after registering an account. Find out more, and sign up right away.