Read time: 5 minutes and 15 seconds

How Do Mutual Funds Work?

In order to invest in securities such as stocks, bonds, money market instruments, and other assets, mutual funds aggregate the funds from shareholders. Professional money managers run mutual funds, allocating the assets and attempting to generate capital gains or income for the fund's investors. The portfolio of a mutual fund is set up and kept up to date in accordance with the specified investment goals in the prospectus.

Small or individual investors have access to professionally managed portfolios of stocks, bonds, and other securities through mutual funds. As a result, each shareholder shares proportionately in the fund's profits or losses. Mutual funds invest in a huge variety of assets, and performance is typically gauged by changes in the fund's overall market capitalization, which are obtained from the performance of its underlying investments combined.

Larger financial institutions like Fidelity Investments, Vanguard, T. Rowe Price, and Oppenheimer are the parent companies of the majority of mutual funds. The fund manager of a mutual fund, also known as the investment adviser, is required by law to act in the best interests of mutual fund shareholders.

KEY LESSONS

- An investment vehicle of this type that consists of a portfolio of stocks, bonds, or other securities is known as a mutual fund.

- Small or individual investors can access diverse, expertly managed portfolios through mutual funds.

The various categories that mutual funds fall under describe the different types of securities, investing goals, and return types that they invest in.

- Annual fees, cost ratios, and commissions paid by mutual funds may have an impact on their overall returns.

- Mutual funds are frequently used by employer-sponsored retirement plans to invest.

The Pricing of Mutual Funds

The performance of the securities that the mutual fund invests in determines the value of the fund. Investors purchase the performance of a mutual fund's portfolio—or, more specifically, a portion of the value of the portfolio—when they purchase a unit or share of the fund. Purchasing shares of a mutual fund is distinct from purchasing stock. Mutual fund shares do not grant their owners any voting rights, in contrast to stock. A mutual fund share is an investment in a variety of stocks or other securities.

The term "net asset value" (NAV) per share, or NAVPS in some cases, refers to the cost of a mutual fund share. The total value of the securities in the portfolio is divided by the total number of outstanding shares to get a fund's NAV. All shareholders, institutional investors, and corporate officers or insiders are considered to have any outstanding shares.

The current NAV of a mutual fund, which doesn't change during market hours but is settled at the conclusion of each trading day, is normally the price at which shares of the fund can be bought or redeemed. When the NAVPS is resolved, a mutual fund's price is likewise updated.

Investors in mutual funds benefit from diversification because the typical mutual fund includes a variety of securities. Think about a shareholder who exclusively invests in Google stock and depends on the company's profitability. Gains and losses are based on the success of the company as all of their money is tied to it. But a mutual fund might own Google because the gains and losses of just one stock are balanced out by the gains and losses of other businesses held by the fund.

How Are Returns for Mutual Funds Calculated?

Investors who purchase Apple shares are actually purchasing a share or a portion of the business. A mutual fund investor purchases a portion of the mutual fund and its assets in a similar manner.

Three common ways for investors to profit from a mutual fund, usually on a quarterly or annual basis, are as follows:

The fund receives revenue from stock dividends and interest on bonds held in its portfolio, and it distributes nearly all of this income to fund owners each year in the form of distributions. Investors in funds frequently have the option of receiving a cheque for dividends or reinvesting the earnings to buy more shares of the mutual fund.

When a fund sells an investment that has appreciated in value, it makes a capital gain, which most funds distribute to investors.

You can sell your mutual fund shares on the market for a profit once the value of the fund's shares rises.

Investors looking at mutual fund returns will notice "total return," or the change in value of an investment over a predetermined time period. Included in this are any income, dividends, or capital gains that the fund made as well as any changes in market value over time. Total returns are often computed for periods of one, five, and ten years as well as from the opening day of the fund, or the inception date.

Mutual Fund Types

Although there are numerous mutual fund varieties, the majority of them fall into one of four broad groups: stock funds, money market funds, bond funds, and target-date funds.

Share Funds

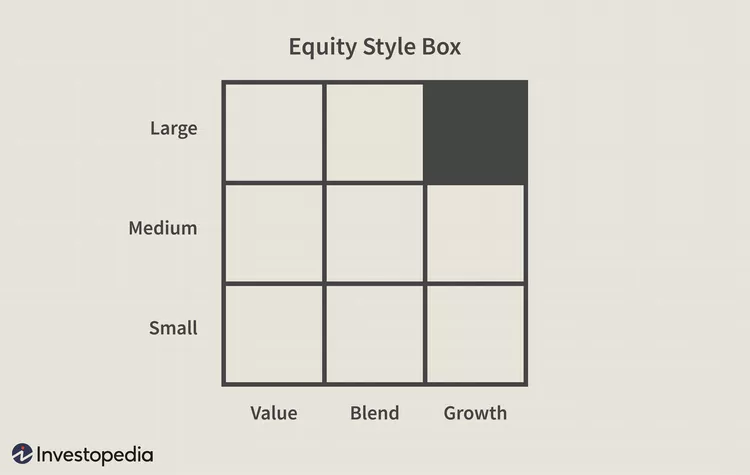

This fund primarily invests in stocks or equities, as the name suggests. There are numerous subcategories within this group. Some equity funds are labeled as small-, mid-, or large-cap based on the size of the companies they invest in. A few others go by the names aggressive growth, income-oriented, value, and others, depending on their strategy for investing. Equity funds can also be divided into those that invest in domestic (U.S.) companies and those that do so overseas. The following style box serves as an example of how to utilize one to comprehend the universe of equity funds.

The size of the companies, their market capitalizations, and the growth potential of the invested equities can all be used to categorize funds. Value funds are a type of investment strategy that seeks out high-quality, slow-growing businesses that are undervalued by the market. Low price-to-earnings (P/E), low price-to-book (P/B), and high dividend yields are characteristics of these companies.

Growth funds, on the other hand, focus on businesses that have experienced rapid increases in earnings, sales, and cash flows. These businesses often don't pay dividends and have high P/E ratios. A "blend," which is simply defined as businesses that are neither value nor growth stocks and are categorized as being somewhere in the middle, is a compromise between rigorous value and growth investments.

Market capitalizations for large-cap corporations are substantial, with values exceeding $10 billion. The market capitalization is calculated by dividing the share price by the total number of outstanding shares. Large-cap equities are often held by blue-chip companies with well-known names. Those stocks having a market cap between $250 million and $2 billion are referred to as small-cap stocks. These smaller businesses are typically younger, riskier bets. The space between small- and large-cap companies is filled by mid-cap stocks.

A mutual fund may combine its investment style and business size strategies. A large-cap value fund, for instance, would focus on large-cap firms with sound financials but recently declining share prices and would be positioned in the upper left quadrant of the style box (large and value). The antithesis of this would be a small-cap growth fund, which makes investments in emerging technology firms with promising growth potential. A mutual fund of this type would be located in the bottom right quadrant (small and growth).

Bond ETFs

The fixed income category includes mutual funds that produce a minimum return. A fixed-income mutual fund concentrates on assets including corporate bonds, government bonds, and other debt instruments that have a fixed rate of return. Interest revenue generated by the fund portfolio is distributed to the shareholders.

These funds, which are also known as bond funds, are frequently actively managed and look to purchase relatively discounted bonds with the intention of reselling them for a profit. While bond funds are not without risk, these mutual funds are expected to offer larger returns. A fund that focuses on high-yield junk bonds, for instance, carries significantly greater risk than a fund that invests in government securities.

Bonds come in a wide variety of forms, thus bond funds can differ significantly depending on where they invest. Additionally, all bond funds are vulnerable to interest rate risk.

Stocks that track an important market index, such as the S&P 500 or the Dow Jones Industrial Average, are purchased by index funds (DJIA). These funds are frequently created with cost-conscious investors in mind because this method needs less research from analysts and advisors, which results in lower costs being passed on to shareholders.

Equilibrium Funds

Stocks, bonds, money market instruments, or alternative assets are all included in the mix of asset classes that balanced funds invest in. This fund also referred to as an asset allocation fund seeks to lower the risk of exposure to various asset classes.

So that the investor can have a predictable exposure to different asset classes, some funds are created using a fixed allocation strategy. To satisfy different investor goals, other funds employ a dynamic allocation percentages technique. This could involve adapting to changes in the market, the business cycle, or the investor's own life phases.

In order to maintain the integrity of the fund's stated strategy, the portfolio manager is frequently given the latitude to change the ratio of asset classes as needed.

Money Market Investments

The short-term debt instruments that make up the money market are secure, risk-free investments, mostly Treasury bills. While the investment is guaranteed, investors won't see significant profits. A typical return is marginally higher than the earnings in a standard checking or savings account and marginally lower than the normal certificate of deposit (CD).

Revenue Funds

The goal of income funds, for which they are named, is to consistently offer current income. These funds invest mostly in reputable corporate and government bonds, holding them until maturity to generate interest income. Although fund holdings may increase in value, the main goal of these funds is to give investors consistent cash flow. As a result, retirees and conservative investors make up the target market for these funds.

Global/International Funds

An international fund, often known as a foreign fund, only makes investments in assets that are situated abroad. However, global funds are able to make investments anywhere in the world. Their volatility is frequently influenced by the specific economic and political dangers of the nation. However, by increasing diversification, these funds can be included in a well-balanced portfolio because returns in other nations might not be connected with returns in the country of origin.

Particular Funds

Sector funds are focused strategic funds intended for particular economic sectors, like the financial, technological, or healthcare ones. Since companies in a certain sector frequently have a high degree of correlation with one another, sector funds can be particularly volatile.

It is simpler to concentrate on a particular part of the world's geography thanks to regional financing. This could entail concentrating on a particular nation or a larger region.

Ethical or socially conscious funds only invest in businesses that adhere to their standards or core values. Tobacco, alcohol, weapons, and nuclear power are a few examples of "sin" businesses that some socially conscious funds avoid investing in. Other funds invest mostly in environmentally friendly technologies, such as solar and wind energy or recycling.

Market-Traded Funds (ETFs)

The exchange-traded fund is a variation on the mutual fund (ETF). Despite using tactics similar to mutual funds, they are not thought of as mutual funds. They have the advantages of stocks in addition to being set up as investment trusts that trade on stock markets.

ETFs can be purchased and sold at any time throughout the trading day. ETFs can also be bought on leverage or sold short. ETFs often charge less in fees than comparable mutual funds. Active options markets, where investors can hedge or leverage their positions, are another advantage for many ETFs.

ETFs benefit from the same tax advantages as mutual funds. ETFs are typically more affordable and liquid than mutual funds.

Fees for mutual funds

A mutual fund may charge shareholders annual running costs. The expense ratio, which typically ranges from 1 to 3 percent of the funds under administration, represents the annual proportion of annual fund operating fees. An investment fund's expense ratio is calculated by adding its advisory or management charge and operating expenses.

Shareholder fees are the commissions, sales fees, and redemption costs that investors directly pay when buying or selling mutual funds. What is referred to as "the load" of a mutual fund are sales commissions or fees. Fees are levied when shares of a mutual fund with a front-end load are purchased. Mutual fund fees are levied for a back-end load when an investor sells their shares.

However, occasionally an investment firm will provide a no-load mutual fund, which has no commission or sales fee. Instead of going through a third party, an investment corporation distributes these funds directly. For early withdrawals or selling the holding before a set period of time has passed, some funds impose fees and penalties.

Classes of Shares in Mutual Funds

Currently, the majority of individual investors use a broker to buy mutual funds that have A-shares. This acquisition also includes management costs and ongoing distribution fees, generally known as 12b-1 fees, in addition to a front-end load of up to 5% or more. In order to increase their commissions, financial advisors who sell these products may persuade clients to purchase higher-load options. In front-end funds, the investor covers these costs at the time of investment.

Investment companies have begun designating new share classes, such as "level load" C shares, which typically don't have a front-end load but carry a 12b-1 annual distribution charge of up to 1%, to address these issues and comply with fiduciary-rule requirements.

Class B shares are funds that incur management and other fees when an investor sells their interests.

Pros of Investing in Mutual Funds

The vast majority of the money in employer-sponsored retirement plans is invested in mutual funds for a variety of reasons, making them the preferred vehicle for individual investors.

Diversification

One of the benefits of investing in mutual funds is diversification, which is the process of combining investments and assets within a portfolio to lower risk. Securities with various capitalizations and industries, as well as bonds with various maturities and issuers, are all included in a diverse portfolio. Diversification can be attained more quickly and affordably by purchasing mutual funds as opposed to individual stocks.

Simple Access

Mutual funds are extremely liquid investments since they can be purchased and sold very easily while trading on the major stock markets. Mutual funds are frequently the most practical—and perhaps the only—way for individual investors to invest in particular types of assets, such as foreign equities or exotic commodities.

The benefits of scale

In addition to offering economies of scale, mutual funds also do away with the multiple commission fees required to build a diversified portfolio. Only purchasing one investment at a time results in high transaction costs. Dollar-cost averaging is made possible for investors by the smaller mutual fund denominations.

A mutual fund's transaction costs are lower than what an individual would pay for securities transactions since it purchases and sells large quantities of securities at once. Unlike a smaller investor, a mutual fund can invest in specific assets or take on larger investments.

Professional Leadership

A seasoned investment manager conducts thorough research and executes trades expertly. A modest investor can hire a full-time manager to initiate and oversee investments relatively cheaply through a mutual fund. Mutual funds enable individual investors to experience and profit from expert money management at a low cost because they have significantly lower investment minimums.

Differentiation and Choice

Investors are allowed to investigate and choose among managers with a diversity of management philosophies. Among many other types, a fund manager may concentrate on value investing, growth investing, established markets, emerging markets, income investing, or macroeconomic investing. Through specialist mutual funds, this diversity enables investors to obtain exposure to not only equities and bonds but also commodities, foreign assets, and real estate. Mutual funds offer domestic and international investment options that might not otherwise be readily available to regular investors.

Transparency

Regulation of the mutual fund sector provides transparency and investor fairness.

Cons of Investing in Mutual Funds

Mutual funds are appealing choices because of their liquidity, diversity, and expert management, but they also have limitations.

No Promises

Your mutual fund's value could decrease at any time, just like many other investments without a guarantee of return. Both the price of equity mutual funds and the stocks in their portfolio fluctuate. Investments in mutual funds are not guaranteed by the Federal Deposit Insurance Corporation (FDIC).

Money Drag

For daily share redemptions, mutual funds are required to hold a sizeable portion of their assets in cash. Unlike a typical investor, funds often need to retain a bigger amount of their portfolio in cash in order to maintain liquidity and the ability to handle withdrawals. Cash is frequently referred to as a "cash drag" because it has no financial return.

High Prices

Mutual funds offer expert management to investors, but fees lower the fund's ultimate payout and are charged to investors regardless of the fund's success. Since fees vary greatly from fund to fund, ignoring fees can have detrimental long-term effects because actively managed funds incur transaction charges that add up over the course of each year.

Dilution and "Diworsification"

A portfolio or investment approach known as "diversification" indicates that too much complexity can produce inferior outcomes. A lot of mutual fund investors like to make things too complicated. In other words, they invest in too many closely similar funds and forfeit the advantages of diversification.

Dilution can also occur when a successful fund becomes very large. When new money floods into funds with a proven track record, the manager frequently struggles to locate suitable investments to make the most of all the additional money.

The Securities and Exchange Commission (SEC) mandates that funds have a minimum of 80% of their assets in the specific investment type that is represented by their names. The fund manager decides how to invest the remaining assets.

However, the various groups that fall under the necessary 80% of the assets may be nebulous and broad. Thus, a fund's title might be used to influence potential investors. For instance, a fund that only invests in Congolese stocks can be marketed under a broad heading like "International High-Tech Fund."

Trading at Day's End Only

In a mutual fund, you can ask to have your shares changed into cash at any time, but unlike stocks, which trade all day long, most mutual fund redemptions only happen at the close of each trading day.

Taxes Capital gains tax kicks in when a fund manager sells the security. Taxes can be reduced by holding non-tax-sensitive mutual funds in tax-deferred accounts, such as a 401(k) or IRA, or by investing in tax-sensitive funds.

Considering Funds

It might be challenging to research and evaluate investments. Mutual funds do not give investors the chance to compare the price-to-earnings (P/E) ratio, sales growth, earnings per share (EPS), or other significant data, unlike equities. The net asset value of a mutual fund can serve as a starting point for comparisons, but given the variety of portfolios, it can be challenging to compare like with like, even when the funds have similar names or stated goals. Only index funds that follow the same markets typically exhibit true comparability.

Illustration of a Mutual Fund

The Magellan Fund from Fidelity Investments is one of the most well-known mutual funds (FMAGX). When it was first established in 1963, the fund's investment goal was to increase capital through investments in common stocks.

When Peter Lynch managed the fund's portfolio between 1977 and 1990, that period saw the fund's greatest level of success. Magellan's assets under management rose from $18 million to $14 billion during Lynch's leadership.

Fidelity's performance remained excellent, and in 2000, assets under management (AUM) increased to almost $110 billion. The fund had grown to such a size by 1997 that Fidelity stopped accepting new investors, and it wouldn't reopen until 2008.

Sammy Simnegar has been in charge of managing Fidelity Magellan since February 2019 and the company had about $28 billion in assets as of March 2022.

The performance of the fund has been comparable to or slightly better than that of the S&P 500.

Investing in mutual funds: Are they secure?

When investing in securities like stocks, bonds, or mutual funds, you run the risk of losing some or all of your money. The money invested in securities is often not federally protected, unlike deposits at FDIC-insured banks and NCUA-insured credit unions.

Can Shares in Mutual Funds Be Sold Anytime?

Shares in mutual funds are regarded as liquid assets and may be sold at any time; nevertheless, you should carefully review the fund's exchange and redemption fee regulations. Capital gains from mutual fund redemptions may potentially have tax repercussions.

What Is a Mutual Fund with a Target Date?

Target-date funds, also known as life-cycle funds, are a popular choice when investing in a 401(k) or other retirement savings plan. If you choose a fund with a target date close to retirement, like FUND X 2050, the fund promises to rebalance and change the risk profile of its investments as the target date gets closer, usually to a more conservative approach.

A Digital Wallet for All Your Web3 Needs, Sponsored

It's easier than you may imagine to gain access to a variety of Defi platforms, from crypto to NFTs and beyond. You can trade and store assets with the help of OKX, a top provider of financial services for digital assets, and benefit from top-notch security. When you perform a deposit of more than $50 through a cryptocurrency purchase or top-up within 30 days of registration, you can additionally connect existing wallets and win up to $10,000. Learn more and register right away.