Investors' preference for index funds, which are investments that mirror the performance of an underlying market index, has increased throughout the years. Investors are given the opportunity to purchase each of the holdings that make up an index by purchasing shares in a fund that follows that index's performance, such as the S&P 500 or the Dow Jones Industrial Average.

Although index funds should be able to duplicate the performance of their respective indices, there is no assurance that a fund's performance will be the same as that of other funds with a similar objective, nor will a fund necessarily be able to mimic the performance of the index it follows. Even while the distinctions between index funds may seem minor at first glance, they have the potential to have a significant bearing on the rate of return an investor receives over the course of their investment.

KEY TAKEAWAYS

- Investors' preference for index funds, which are investments that mirror the performance of an underlying market index, has increased throughout the years.

- There is a wide range of fees and expense ratios or operating expenditures that can eat away at an investor's return when investing in index funds.

- There is a possibility that an index fund will not precisely track the underlying index or sector, which may result in tracking mistakes or differences between the fund and the index.

- There are some index funds that may only hold a few components, and because of this lack of diversity, investors may be at increased risk of incurring losses.

- Understanding the Secret Variables That Separate Index Funds from One Another

A sort of exchange-traded fund (ETF) known as an index fund is one that holds a collection of stocks or other securities that are designed to replicate the performance of a pre-existing financial market index. Index funds, for instance, are funds that follow an index such as the Standard & Poor's 500 Index. Investors are not able to buy the index itself; however, they are able to buy shares of index funds, which are supposed to be identical to the index. To put it another way, an index fund that tracks the S&P 500 would include each and every one of the 500 equities that make up the S&P 500. Index funds are typically used to offer investors exposure to the entire market or to the overall performance of a particular industry.

As a consequence of this, index funds are considered to be passive investments. This is due to the fact that the fund's portfolio manager does not engage in active stock choosing by purchasing and selling assets on behalf of the fund. Instead, a fund manager will choose a variety of assets to form a portfolio that is designed to mirror the performance of an index. When compared to actively managed funds, passively managed funds typically have lower operating expenditures due to the fact that the fund's underlying assets are simply kept rather than actively traded.

At first glance, it may appear reasonable to assume that an index fund should closely follow the performance of the index it is monitoring and that other funds that follow the same index should all achieve the same level of success. On the other hand, a closer inspection reveals several differences between the various sorts of funds.

Expense Ratios

The amount of money that a fund spends on operating expenditures is one of the factors that sets it apart from other index funds. These are expressed as a ratio, which shows the percentage of expenses compared to the amount of yearly average assets under management. Expenses are expressed as a percentage of assets under management.

Investors who choose to put their money into index funds should, in theory, anticipate cheaper operating charges because the fund manager is not responsible for selecting or managing any of the underlying securities. However, operating expenses can differ between funds. When it comes to investing, it is very crucial to keep expenses in mind because they have the potential to lower an investor's return.

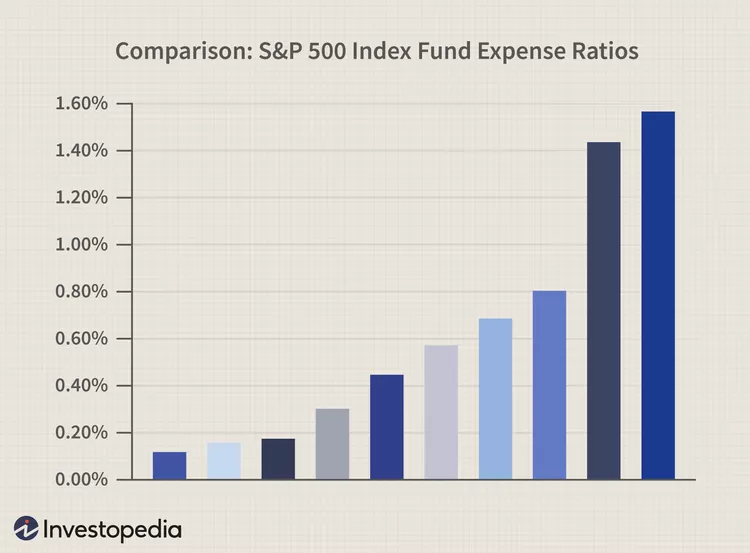

Take a look at the following table for a comparison of 10 funds that invest in the S&P 500 and their expense ratios as of April 2003:

The various funds are represented by their respective types of bars in this chart. Keep in mind that the annual return of the S&P 500 was around 5% as of the end of April 2003, taking into account the fact that expense ratios can range anywhere from 0.15% to almost 1.60%. If we assume that the fund replicates the index very accurately, an expense ratio of 1.60 percent will cut an investor's return by approximately 30 percent.

Index funds with almost similar portfolio mixes and investment strategies can have a variety of cost structures despite their shared use of the same indexing methodology. Front-end loads are fees or sales costs that are applied upfront when an investment is initially purchased. Certain index funds have front-end loads, but not all of them do. Back-end loads are fees and commissions that are incurred when an investment is sold by some funds. These fees are known as "back-end loads." Other expenses include something called a "12b-1 charge," which refers to the fund's annual distribution or marketing fees. The 12b-1 fee, on the other hand, may be assessed on its own or may be incorporated into the fund's overall expense ratio.

Before investing in an index fund, it is important to take both the fees and the expense ratio into consideration. Some funds may provide the impression of being a better buy due to the fact that they may charge a low expense ratio; nonetheless, these funds may additionally charge a back-end load or a 12b-1 fee. When added up over time, the fees and expense ratio can have a significant impact on the return that an investor receives from their investment.

Most of the time, larger and more reputable funds have a tendency to charge lesser fees. As an illustration, the expense ratio for the Vanguard 500 Index Admiral Shares fund (VFIAX), which follows the stocks of 500 of the major firms in the United States, is 0.04% as of the 29th of April, 2021.

The lower fees could be the result of management experience in monitoring indexes, as well as a larger asset base, which could boost the capacity to leverage economies of scale when purchasing securities. Alternatively, the larger asset base could be the cause of the lower fees. Large businesses are able to enjoy significant cost savings and other advantages thanks to economies of scale, such as the ability to buy in bulk at a reduced price per unit.

Tracking Errors

Comparing the tracking errors of different index funds and measuring how each fund deviates from the index it attempts to replicate are two more excellent methods for evaluating index funds.

The tracking error is a measurement that determines how big of a difference there is between the value of the fund and the value of the index that the fund is tracking. The tracking error is typically reported as a standard deviation, which indicates the amount of variation or dispersion that exists between the price of the fund and the average or mean price for the underlying index. This variance or dispersion is measured in percentage terms. Significant differences in performance between an index fund and its benchmark are indicated by large deviations in the performance of the fund.

This significant disparity might suggest that the fund was constructed poorly, that its fees were excessive, or that its operating expenses were high. It is possible for an index fund's return to be much lower than the return of the index because of the fund's high fees, which would result in a considerable tracking error. As a consequence of this, any variation can result in the fund realizing lesser gains or higher losses.

The following graph presents a comparison of the returns of the S&P 500 (shown in red), the Vanguard 500 Index Admiral Shares (represented in green), the Dreyfus S&P 500 (represented in blue), and the Advantus Index 500 B (represented in blue) (purple). Observe how the index fund's performance deviates from the benchmark to a greater extent when expenditures rise.

The assets held by a fund

Even when the name of a fund includes the term "index fund," this does not always indicate that the fund adheres strictly to the underlying index or sector. When searching for an index fund, it is essential to keep in mind that not all index funds with names like "S&P 500" or "Wilshire 5000" strictly adhere to the performance of their respective indexes. Some funds can have diverging management behavior. To put it another way, the fund's portfolio manager might include equities in the fund that are comparable to those that are included in the index.

One good example is the Devcap Shared Return fund, which is a socially responsible index fund that tracks the S&P 500. As of the 4th of June in 2003, the expense ratio was 1.75 percent, and the 12b-1 fee was set at 0.25 percent. Another fund known as the ASAF Bernstein Managed Index 500 B was classified as an S&P 500 index fund; nevertheless, its primary objective was to outperform the performance of the S&P 500.

There is typically room for subjectivity on the part of the investment manager who is in charge of sector index funds, which are designed to track specific economic segments of the economy. For instance, the SPDR S&P Homebuilders exchange-traded fund, often known as XHB, is recognized for its ability to monitor equities in the homebuilding business. An investor who purchases the fund might wrongly believe that it only consists of homebuilders. However, a portion of the holdings are equities in businesses that are connected to the sector. For instance, Whirlpool Corporation (WHR), which is an appliance manufacturer, Home Depot (HD), which is a home supply store, and Aaron's Inc., which is a retail establishment that sells furniture on a rent-to-own basis, are all included in this.

If the portfolio manager of an index fund provides additional management services, the fund is no longer considered passive and is instead considered active. To put it another way, a fund may have the objective of outperforming the index, such as the S&P 500, which may result in holdings that consist of firms and securities that are not included in the index that is being followed. As a direct consequence of this, mutual funds that have additional selling features tend to have fees that are significantly higher than usual.

Before making an investment in an index fund, prospective buyers should carefully examine the fund's holdings to establish whether or not the fund is indeed an index fund and not just a fund with a name that sounds like an index.

Insufficient Level of Diversity

There are certain funds listed within the index fund category that do not have the same level of diversification as those that track an index such as the S&P 500. There are many index funds that have the same characteristics as funds that are targeted, value-oriented, or sector-oriented. However, it is important to keep in mind that specialized funds typically only hold a maximum of thirty companies or assets from the same industry. When compared to a fund that tracks the S&P 500, which is made up of 500 companies operating in a wide variety of economic fields, the lack of diversification that is present in sector funds can put investors at a greater risk of financial loss.

Taking Into Account Particulars

Before investing money in index funds, it is important to conduct thorough research to determine whether or not the funds have minimal to no tracking errors and whether or not their expense ratios and fees are high. Additionally, it is essential to have a solid understanding of the objective that the investment manager has in mind for the index fund as well as the assets and investments that are included in the fund in order to accomplish this objective. The fund's investments may move in a direction that is different from the underlying index if the goal is regarded to be aggressive.

Understand the hidden differences between index funds: https://t.co/JLBQkGqFmW pic.twitter.com/S4biNs5nH1

— Investopedia (@Investopedia) November 14, 2022

The necessity to take into account fees becomes even more significant in relation to the increased risk factors because costs lower the amount of return earned in exchange for the risks that are accepted. Consider the following comparison of funds tracking the Dow 30 index:

The choice of assets that an investor makes can be influenced by their level of comfort with risk as well as their time horizon. Because the objectives may include the preservation of the portfolio and the provision of income, a retiree is likely to look for index funds that are either conservative or low-risk. A Millennial, on the other hand, might opt for an investment fund that has a more risky investing plan that is geared to offer growth. This is because Millennials have more time to make up for any losses incurred as a result of market declines. When selecting an index fund, your level of comfort with risk and the amount of time you plan to invest are two crucial factors to take into account.

SPONSORED

While Trading Digital Assets, You Could Win Up to $10,000.

Digital asset trading just become easier. When you trade assets and store them with OKX, a renowned provider of digital asset finance services, you have access to the highest possible level of protection. In addition to this, if you make a deposit of more than $50 through a cryptocurrency purchase or top-up within the first 30 days of registering an account, you will be entered into a drawing to win a Mystery Box with a value of up to $10,000. Find out more and sign up to get your Mystery Box right away by clicking here: