- A trio of important market-moving events are scheduled to take place in June, which should make for another tumultuous month on Wall Street.

- The markets will be paying close attention to the U.S. jobs report, inflation data from the CPI, and the highly anticipated policy meeting from the Fed.

- As a result of this, investors have to brace themselves for more jarring swings and abrupt shifts in the weeks to come.

Are you looking for some assistance in the market place? Members of InvestingPro have access to special information and coaching to help them succeed in any market environment. Read on for more.

As investors continue to assess the forecast for interest rates and inflation while waiting for a political resolution to the crisis over the debt ceiling in the United States, the stock market on Wall Street is on track to close the month of May on a shaky note.

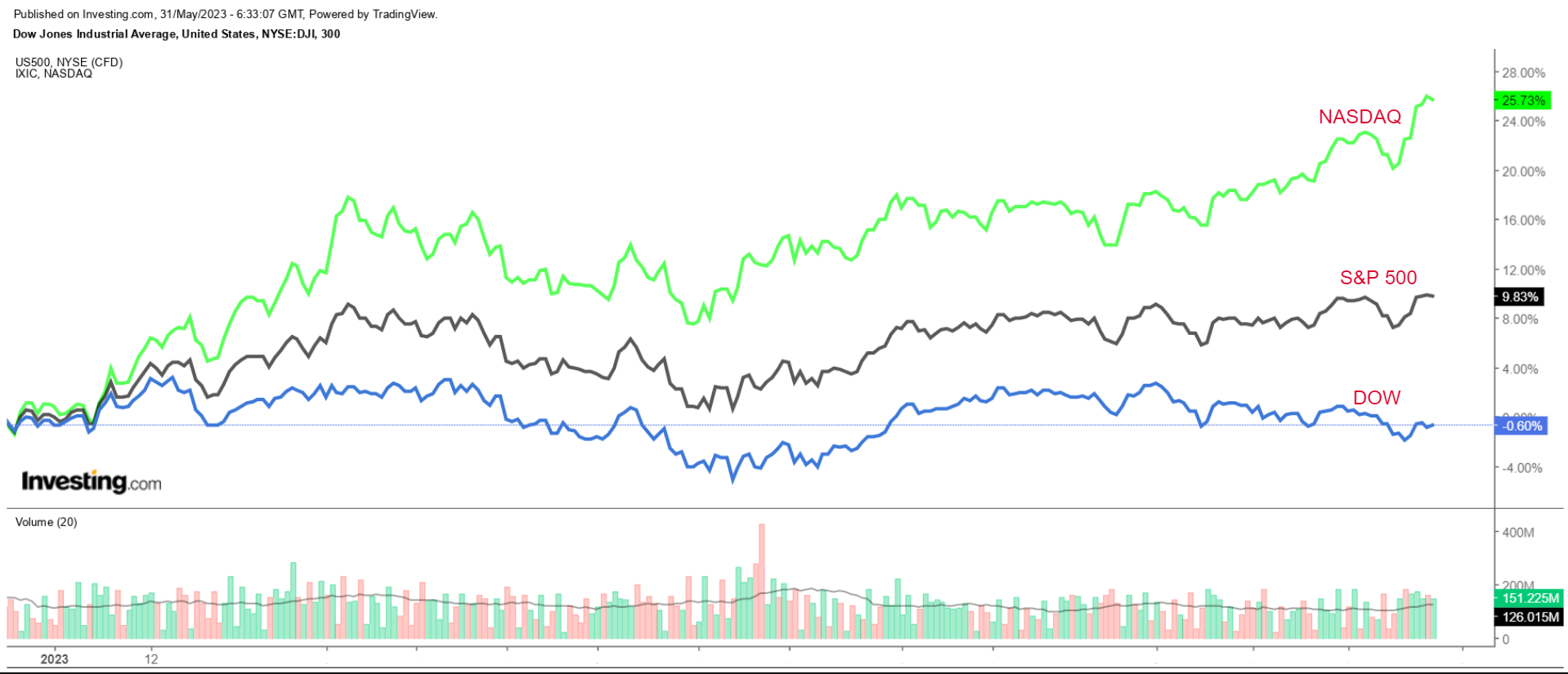

The tech-heavy Nasdaq Composite is on course to come out on top in May, with a gain of almost 6.5% heading into the final trading session of the month. This is due to investors piling into AI-related companies, such as Nvidia (NASDAQ:NVDA), which has attracted a lot of investor interest recently.

The widely followed S&P 500 index has gained approximately 0.9% so far this month.

As of the market's close on Tuesday, the blue-chip Dow Jones Industrials Average had lost 3.1% of its value, making it the index that is expected to do the worst in May.

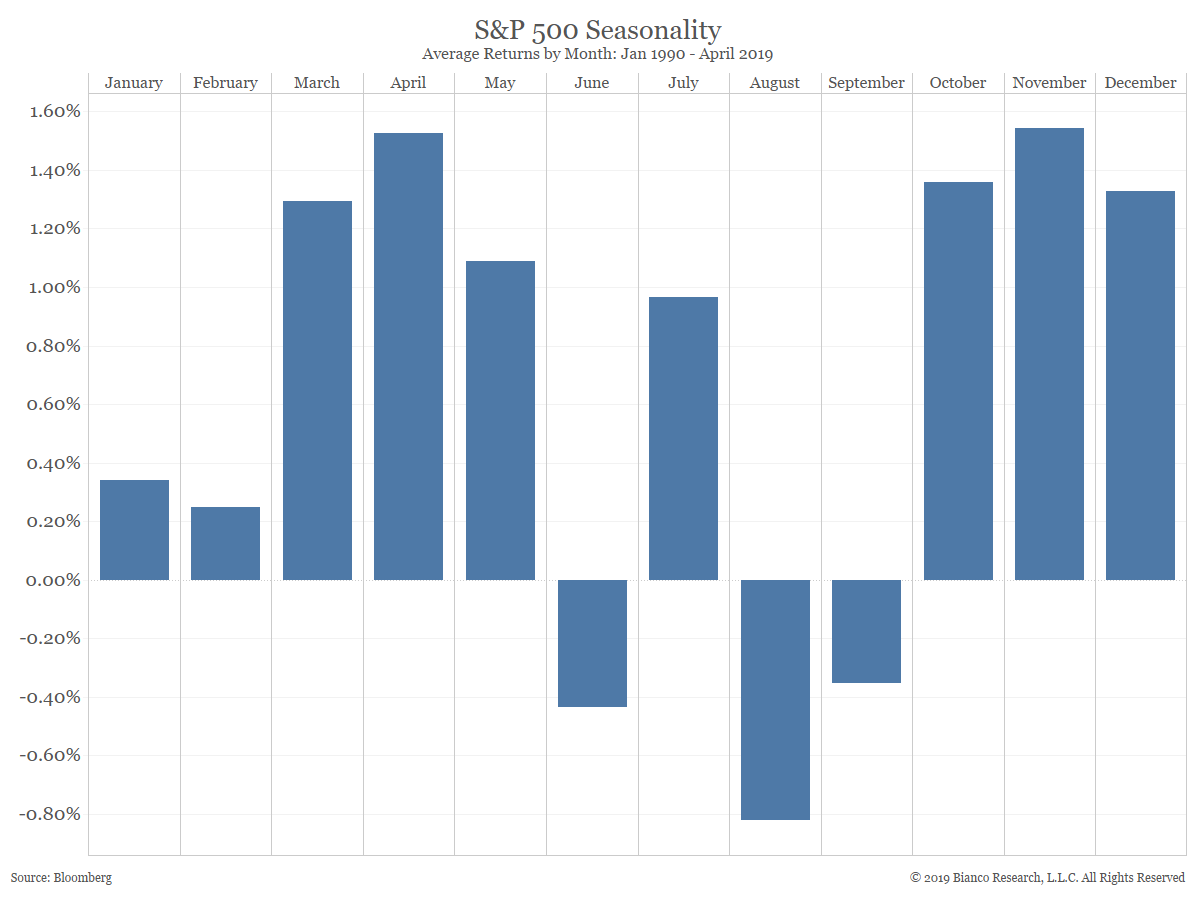

As the month of tumultuous May comes to a close, investors should brace themselves for further volatility in June, which has a reputation for being one of the worst months of the year for the stock market. Investors should prepare themselves for fresh turmoil in June.

5 Stocks to Buy for October After a Dreadful September The U.S. stock markets witnessed a broad-based decline in September. Although historically September is the worst-performing month on Wall Stree https://t.co/nwZimc16fx

— of today (@_oftoday_) October 5, 2022

Since 1990, the S&P 500 has had a monthly loss of approximately 0.4% on average in the month of June, and it's possible that this year will be no different.

As a result, here are three significant dates to keep an eye on as we go into the month of June:

1. The United States Employment Situation: Friday, June 2

On Friday, June 2, at 8:30 AM Eastern Time, the United States Department of Labor will publish the jobs report for the month of May. It is anticipated that this data will play a significant role in shaping the next policy decision that the Federal Reserve will make.

According to Investing.com, the general consensus is that the data will indicate that the economy of the United States added 180,000 employment. This would be a significant slowdown from the jobs increase of 253,000 in April.

It is anticipated that the unemployment rate will gradually climb to 3.5%, a touch higher than the previous month's 53-year low of 3.4%, which was a level that had not been seen since 1969.

Prediction:

- I expect that the employment report for the month of May will reinforce the notion that additional rate hikes will be required to rein in the red-hot labor market and will highlight the amazing resilience of the labor market.

- In the past, Fed officials have said that the unemployment rate needs to be at least 4.0 percent in order to decrease inflation. However, other economists believe that the unemployment rate would need to be considerably higher in order to achieve this goal.

- To put things into perspective, the unemployment rate was 3.6% precisely one year ago in May 2022. This indicates that the Federal Reserve still has leeway to raise rates, even though traders are banking on a pause in rate hikes at this point in time.

2. CPI Data for the United States: Tuesday, June 13

On Tuesday, June 13, at 8:30 AM Eastern Time, the consumer price index report for May will be released, and it is highly likely that the numbers will show that neither overall inflation nor core inflation are falling fast enough for the Federal Reserve to cease its efforts to combat inflation.

In spite of the fact that no official projections have been made as of yet, economists anticipate that the annual CPI will rise by between 4.6% and 4.8%, which is a slowdown from April's annual pace of 4.9%.

The headline annual inflation rate reached a 40-year high of 9.1% last summer and has been on a steady downward trend since then. Despite this, prices are still rising at a pace that is over twice as fast as the Fed's goal range of 2%.

In the meantime, projections for the year-on-year core figure, which does not include changes in the cost of food or energy, range around 5.4%-5.6%, which is a slight increase from April's reading of 5.5%.

Officials at the Federal Reserve keep a close eye on the underlying number because they believe it provides a more accurate view of where inflation is headed in the future.

Prediction:

- Even while the overall trend is downward, the data will probably show that inflation is still climbing at a rate that is far higher than the 2% rate that the Federal Reserve regards to be a healthy rate.

- In my opinion, there is still a significant distance to travel before the policymakers at the Fed can confidently state that their mission regarding inflation has been fulfilled.

- A report that is unexpectedly strong, in which the headline CPI number arrives at 5.0 percent or above, will shatter hopes even more for a halt in June and retain pressure on the Fed to continue its fight against inflation.

3. The decision on the Fed rate will be made on Wednesday, June 14

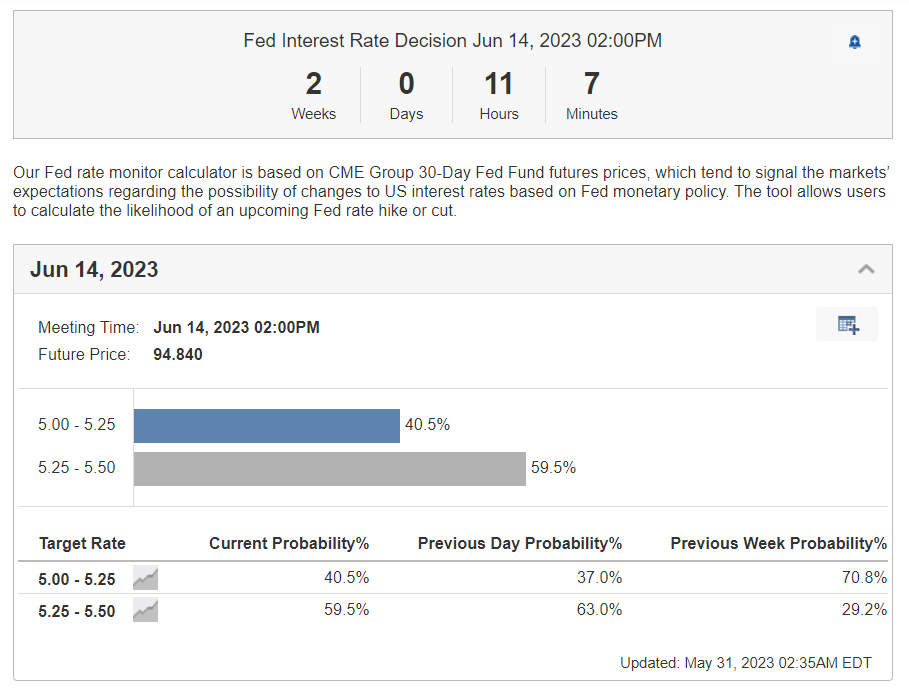

On Wednesday, June 14, at 2:00 p.m. Eastern Time, the Federal Open Market Committee is set to come to a conclusion, and the Federal Reserve will then announce its policy decision.

According to the Fed Rate Monitor Tool on Investing.com, as of the beginning of Wednesday morning, the financial markets are pricing in an approximately 60% possibility of a rate increase of 25 basis points and a near 40% chance of no action from the Federal Reserve.

But this, of course, is subject to change in the days and weeks running up to the big rate decision. This will rely on the data that comes in as well as the ongoing attempts to get Congress to support the deal to raise the debt ceiling.

If the Federal Open Market Committee decides to raise interest rates by another quarter of a percentage point, it will be the 11th time in the past 13 months that they have done so. This would place the benchmark Fed funds target range in a range that is between 5.25 percent and 5.50 percent.

Shortly after the release of the Fed's statement, Fed Chair Powell will have a news conference that will be keenly monitored by investors looking for fresh hints on how he perceives inflation trends and the economy and how that will effect the pace of monetary policy tightening. Investors are looking for fresh clues as they look for fresh clues on how he views inflation trends and the economy and how that will impact the speed of monetary policy tightening.

related link: The Reasons Why Corporations Issue Bonds

Prediction:

- My gut feeling is that the Federal Reserve will opt to raise interest rates by 25 basis points at their meeting in June due to the fact that inflation is continuing to be persistently high and the overall economy is holding up better than projected. In addition, I think Powell will strike a tone that is rather hawkish and warn that there is still more work for the Fed to do in order to drive inflation down from its sticky level.

- Although I concur that the present round of monetary policy normalization may be getting close to its conclusion, I believe that the policy rate will need to increase by at least another half of a percentage point, to a range that lies between 5.75% and 6.00%, before the Federal Reserve will even consider the possibility of pausing its efforts to bring price stability back to the economy

- If the Federal Reserve of the United States decides to loosen monetary policy too soon, it runs the risk of committing a major policy blunder, which might result in inflationary pressures beginning to reassert themselves despite concerns about an impending economic collapse.

If it follows the numbers, the Federal Reserve has more room to increase interest rates than it has to lower them. In other words, the Fed can do either.

Where Do We Go From Here?

Once again, it is not a well-kept secret that we are about to enter one of the months of the year that typically has the lowest output. As a result, some form of weakening in June would not, in my opinion, come as a surprise.

In the near term, I anticipate a downward correction in the U.S. stock market because the Federal Reserve may continue to raise interest rates through the summer and may keep them higher for a longer period of time.

Traders whose primary strategy involves entering long positions might decide to take some time off during the month of June, or they might decide to leave their positions more quickly than usual and go to the sidelines if the market starts to turn.

Long-term investors, on the other hand, may wish to buy the fall in risk assets in order to take advantage of the cheaper pricing, since previous market performance implies that the market may bounce back rapidly in July.

In general, it is essential to maintain patience and keep one's eyes peeled for opportunities. Increasing one's exposure gradually, avoiding the purchase of equities with extended holding periods, and avoiding being overly concentrated in a single firm or industry are all still crucial.

Having this information in mind, I made a watchlist of high-quality stocks using the stock screener on InvestingPro. These stocks are excelling in terms of their relative strength despite the challenging conditions of the market at the moment.

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Meta Platforms, Tesla (NASDAQ:TSLA), Visa (NYSE:V), United Health (NYSE:UNH), Exxon Mobil (NYSE:XOM), Broadcom (NASDAQ:AVGO), and Chevron (NYSE:CVX) are just a handful of the companies that made the list. This should not come as a surprise.